Yes, you read the title right! Tulip Mania illustrates one characteristic of a soap bubble – impermanence, or in easier terms, vulnerability!

What Is A Market Bubble?

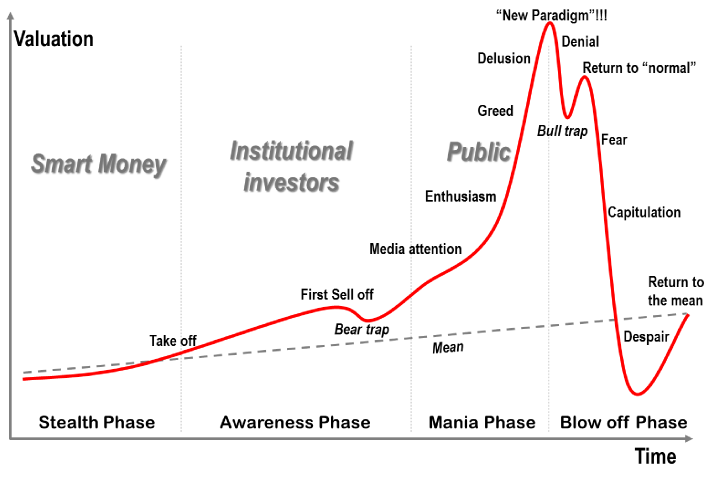

A market bubble is an economic process incorporating a rapid escalation of asset prices driven vivacious market behavior followed by a contraction accounting to an enormous sell-out, causing the bubble to deflate. The primary cause of these bubbles is changing investing behavior. It is a bubble, but the financial bubble shows not so regular trends. Have a look here –

Understanding a financial bubble – The mania phase

The Dutch Tulip Mania is one of the most famous market bubbles that occurred in Holland during the 1630s when tulip bulbs became the new status symbol for the community.

Background

In the late 1500s, the tulip, the beautiful flower, made its entry in Western Europe. The flower, known for being very fragile, demands careful cultivation. This indeed was a challenging task as tulips could hardly be transplanted or even kept alive for that matter. The flower being one of its kind, soon became an extravagance, foreordained only for gardens of the elite class.

But how could others not follow?

Apparently, it’s not just India where the society follows the affluent.

In no time, the Dutch society too started purchasing them.

The Exponential Rise

If we understand this journey analogous to a sine wave, it is at value 0 at time 0, 1 at time t, and 0 again at a time (xt). In between, there’s just a journey to reach from 0 to 1 and then 1 to 0.

That’s what happened here in Holland. The rising demand for tulip bulbs motivated professional cultivators of the tulip to refine the production methods and naturally, businesses started flourishing and have lasted to this day. Eventually, the Dutch learned that tulips could grow from both seeds and buds from mother bulbs. Another interesting finding was that broken bulbs yielded striped and multicolored tulips, that had a higher market price.

FFA6KG TULIPS, 17th CENTURY. Showing the variety of Tulips- three tulips and an anemone. Color pencil by Jacob Marrel (1614-1681).The desire to possess tulip bulbs, especially the broken bulbs gave rise to an enormous Tulip Mania in Holland around 1634. Everyone in the country, from chimney sweeps to the elite, wanted to invest whatever they had into tulip trade. Thinking that the prices would only rise in the time, people even began tulip trade by taking loans. The market price shot and the demand for tulip trade never ceased. The tulip trade had reached the peak value now, and further, it only had to similar to the wave in the sine graph. In the language of business, financial bubbles burst when the expectations reach a tipping point.

The Sharp Decline

And unfortunately, by the end of 1637, these prices began to plunge. Those who had purchased the bulbs on credit had no option but to sell their bulbs at any price, leading to bankruptcy. Liquidity leading to bankruptcy, the bubble had burst, the future looked bleak now!

Conclusion

This incident has been a subject of several books since the 1630s and became a byword for insanity in the market. It is a classic example of a financial bubble because the price hike wasn’t because of its intrinsic value but due to the overwhelming demand and the profit-yielding capacity of tulip bulbs. It’s not that this never repeated, but the volatility of markets was explored by the Dutch in this era.

What Did We Learn?

What Did We Learn?

Well, quite a lot.

The financial crisis was still less intense than the shock, which the population of Holland experienced. And since then, the tulip bubble, or better said the Tulip Mania, has been serving as a moral lesson for those in the market. Excess of anything is bad. There is a place for a man’s need but not his greed. And in the language of business, chasing prices can sometimes get you to pay a big price because what goes up, has to come down!

All images belong to their respective owners.